Atal Pension Yojana Closure Process Explained | APY Account Closing

APY Account Closure: Atal Pension Yojana was introduced by Government of India to provide pension to unorganized sector workers. Minimum age for opting for APY scheme is 18 years and maximum age to apply for the scheme is 40 years. As per the scheme, the subscriber has to make monthly contribution of certain fixed amount from the time of subscription.

Table of Contents

1. Download APY Account Closure form

2. How to fill APY Voluntary exit form

3. How to get your PRAN

4. APY closure FAQ

The contribution can be made monthly, quaterly or half yearly basis.

Opening APY account is not difficult at all. Simply by visiting your branch, you can ask for APY account form in which you have to fill few details and sign on it.

However real problem starts when you have to close your APY account. You will find that bank staff is not very co-operative when you are about to close APY account. So we have decided to guide you through the complete step by step process of APY account closure.

Voluntary exit from APY is possible and anyone who is not willing to participate for the scheme can withdraw from it before age of 60.

One has to be ready with ‘Atal Pension Yojana (APY) – Account closure form’ – voluntary exit form & PRAN number.

Download APY account Closure form

You can download APY account closing form from here.

Here is how the form looks

How to fill the APY voluntary exit form?

Fill up the details in the form carefully as explained below.

PRAN Number: If you don’t have PRAN number, then you may refer the next section to get it.

Name of PRAN holder: Your name

Saving Bank Account Number: This is the account where you will receive all the contributions that you have made so far. Ideally, this is the same account from which APY deductions are occuring.

Reason for closure: Tick on any of the reasons mentioned in the list.

Date & signature of the subscriber

How to get PRAN number?

PRAN (Permanent Retirement Account Number) is uniquely assigned to an individual who opts for Pension Scheme of Government of India.

If you don’t know your PRAN number, you should follow below mentioned steps:

Step 1:

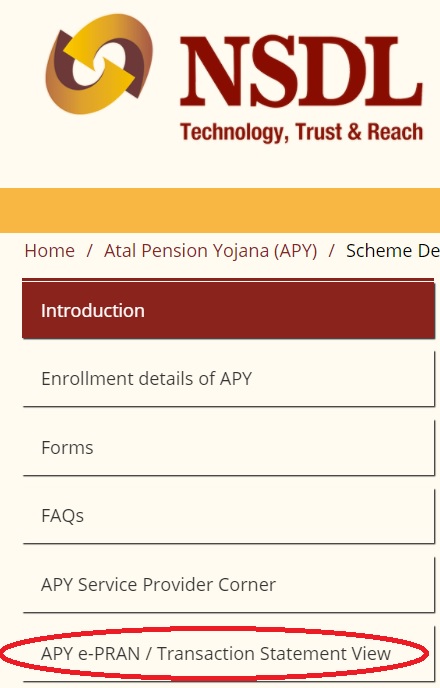

Click here to directly visit APY scheme details on NSDL website.

Step 2:

Click on ‘APY e-PRAN/Transaction Statement View’ link in the left sidebar

Step 3:

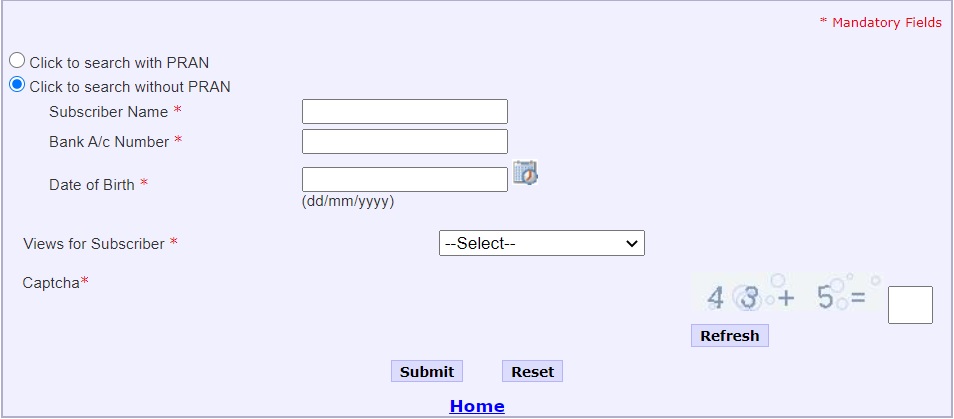

You will now be on the next page where you will see two options as below

1. Click to search with PRAN

2. Click to search without PRAN

Select ‘Click to search without PRAN’.

Next you will have to enter your details such as

Subscriber Name: Your Name

Bank A/c Number: Account Number linked with APY

Date of Birth: Your DOB as provided to Bank

Views of Subscriber: Select APY e-PRAN and Master details view

Enter the captcha and click on submit button.

You will get your PRAN number after you click on submit button.

APY Closure FAQ

Ans: No. Currently there is no lock in period for the contributions made to APY scheme.

Ans: As per the rules, if subscriber voluntarily exits from APY before age of 60, he/she shall be refunded all the contributions made by him/her to APY, along with net actual income earned on his/her income. Account maintenance, asset management charges will be applicable.