BOB RTGS NEFT Form: Download, Sample Form Filling & Writing Cheque

Although most of the part of banking system has become digitalized, there are still some matters that we need to settle down by visiting bank only. These may include making payments to your supplier, in case you are business entity or paying to third party just to have actual record of payment. In any case, we need to visit bank. Bank of Baroda offers easy access to their customers for all kind of services including funds transfer. However, the visit to branch is not always so smooth, as sometimes you need to visit the BOB branch and fill up the RTGS form & cheque and make sure the information you put in is correct and valid.

In order to solve your problem, we are here with a detailed step by step guide to BOB RTGS form filling, RTGS/NEFT cheque filling and literally everything that you have to do the moment you enter your branch.

To understand the BOB RTGS form filling process clearly, we will consider a fictitious example of Mr. Raj, who is having account in Bank of Baroda and he has to send sum of INR 500,000 to Ms. Simran immediately. Ms. Simran has her bank account in Canara Bank, Dombivali branch.

You can skip to any of the part that you need directly by clicking on the table of content section.

Table of Content

1. BOB RTGS/NEFT Form Download

2. What to choose RTGS/NEFT?

3. How to fill the RTGS cheque?

4. How to fill the NEFT cheque?

5. BOB sample RTGS/NEFT filled up Form

BOB RTGS NEFT Form Download

First you will need to access BOB RTGS/NEFT Form. This one is easy, you can download it from here.

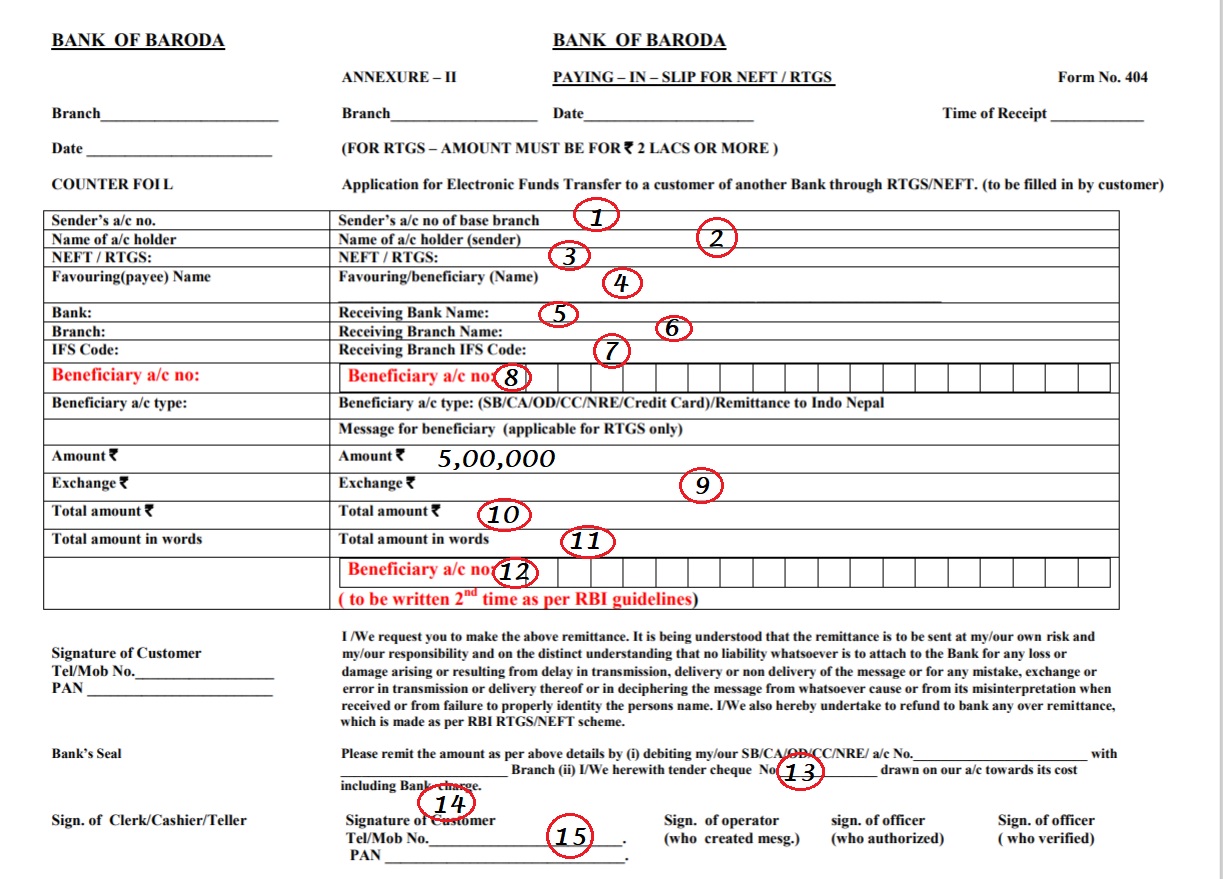

This is how the complete unfilled BOB RTGS or NEFT form looks like

The next step is to fill up this form

What should I do RTGS or NEFT?

Now, Mr. Raj has downloaded this ‘BOB RTGS/NEFT Form’ from our website. And now he is not sure about how to fill up this form correctly.

Here Mr. Raj first needs to be clear about whether he has to apply for NEFT or RTGS. The answer is simple, NEFT can be performed for any amount with no minimum or max limit. However, the RTGS can only be performed for amount of Rs 2 Lakh or more.

NEFT amount are settled in batches in simple language, the amount may take a while to reach Simran’s account from the time it was debited from Mr. Raj’s account if he performs NEFT transaction.

RTGS amount on the other hand is settled in real-time i.e., the moment it is debited from Mr. Raj’s account the next moment it will appear in Ms. Simran’s account.

So considering the urgency of the situation, Mr. Raj must go with RTGS transaction.

How to write the BOB RTGS cheque

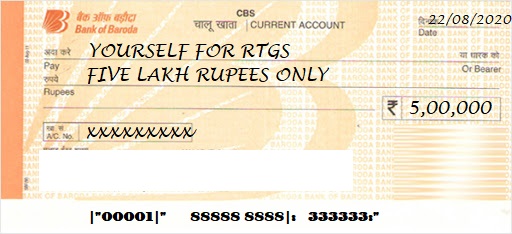

Now Mr. Raj doesn’t know what to write on the cheque. He is confused about whether to write Simran’s actual name or something else on the cheque. Well, writing Simran’s name might seem logical, but it is not correct way to fill a RTGS cheque.

In front of Pay, Mr. Raj will write, ‘Yourself for RTGS’.

Refer the sample filled cheque image below

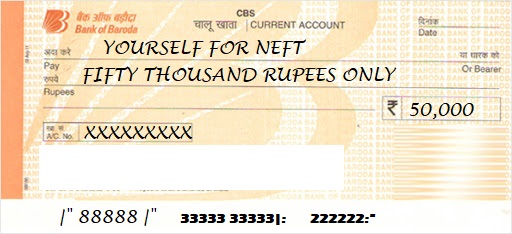

How to write the BOB NEFT cheque

Similarly in case of NEFT transaction, Mr. Raj must write ‘Yourself for NEFT’. Again refer the image given below.

BOB RTGS/NEFT filled up sample Form

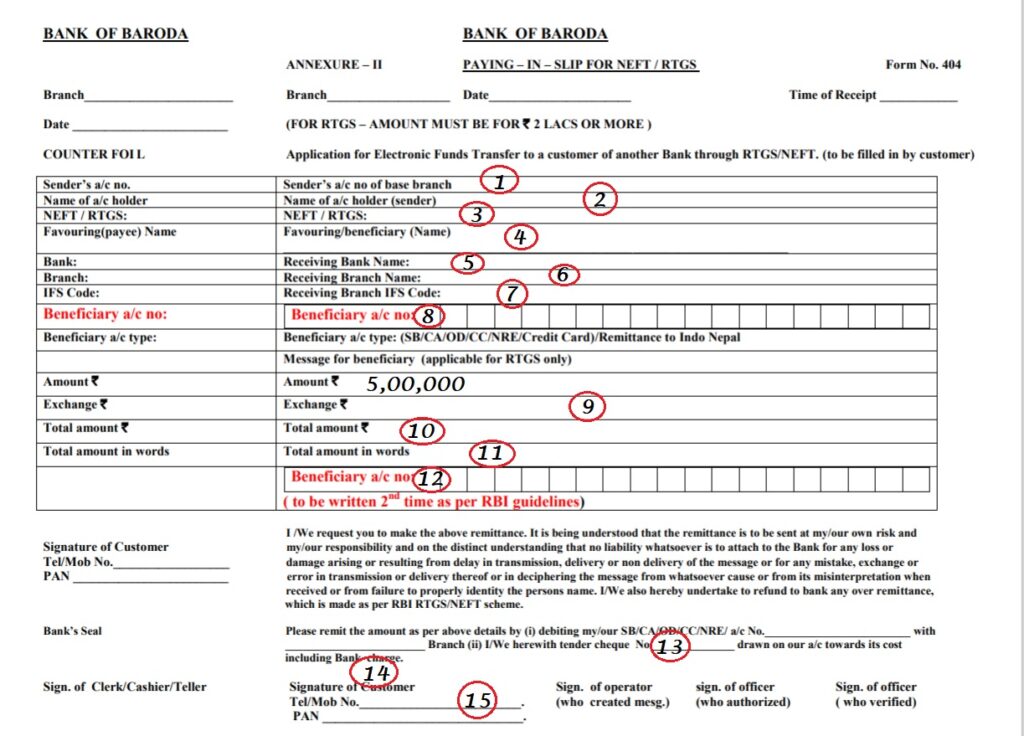

Finally it is time to fill up the actual RTGS Form. Below is image of BOB RTGS form with numbers mentioned on it. You can refer the numbers in the image and in the table given below the image to understand how to fill complete RTGS form.

| Sr. No | What to write | What Mr. Raj Will write |

| 1 | Your BOB Account Number | Raj’s BOB Ac Number |

| 2 | Your Name | Mr. Raj Malhotra |

| 3 | RTGS/NEFT mention type of transaction | RTGS |

| 4 | Intended receiver’s name | Ms. Simran Saxena |

| 5 | Receiver’s bank name | Canara Bank |

| 6 | Address of receiver’s bank | Dombivali East |

| 7 | IFSC code of Receiver bank | CNRB0XXXXXX |

| 8 | Account Number of person to whom amount is to be sent | Ms. Simran’s account number |

| 9 | The charge on transaction | Charges |

| 10 | Total amount: Amount + charge of transaction | Total Amount |

| 11 | Total amount in words | The amount + charge |

| 12 | Repeat the beneficiary’s account number | Ms. Simran’s account number |

| 13 | Attached Cheque Number | Cheque number |

| 14 | Your Signature | Mr. Raj’s signature |

| 15 | Your mobile number | Mr. Raj’s mobile number |

Bank of Baroda provides various financial services to their customers, you may refer these in detail guides mentioned below.

Bank of Baroda FASTag

Bank of Baroda Net Banking Guide

How to generate Bank of Baroda Mini Statement