CBI RTGS Form Download CBI NEFT Form

Central Bank of India, provides fund transfer facilities with the services like RTGS and NEFT. For conduction fund transfers using net banking, you will have to register for CBI net banking first. If you want to send bigger amount then you can opt for RTGS services of CBI, for which you will have to visit the branch and fill up the RTGS / NEFT form.

CBI RTGS / NEFT services

Real Time Gross Settlement (RTGS) system introduced in Indian Financial system is integrated and trustworthy payment system developed by Reserve Bank of India. In order to perform RTGS from your Central Bank of India account, there are 2 ways

- Using Net Banking

- Using CBI RTGS Form

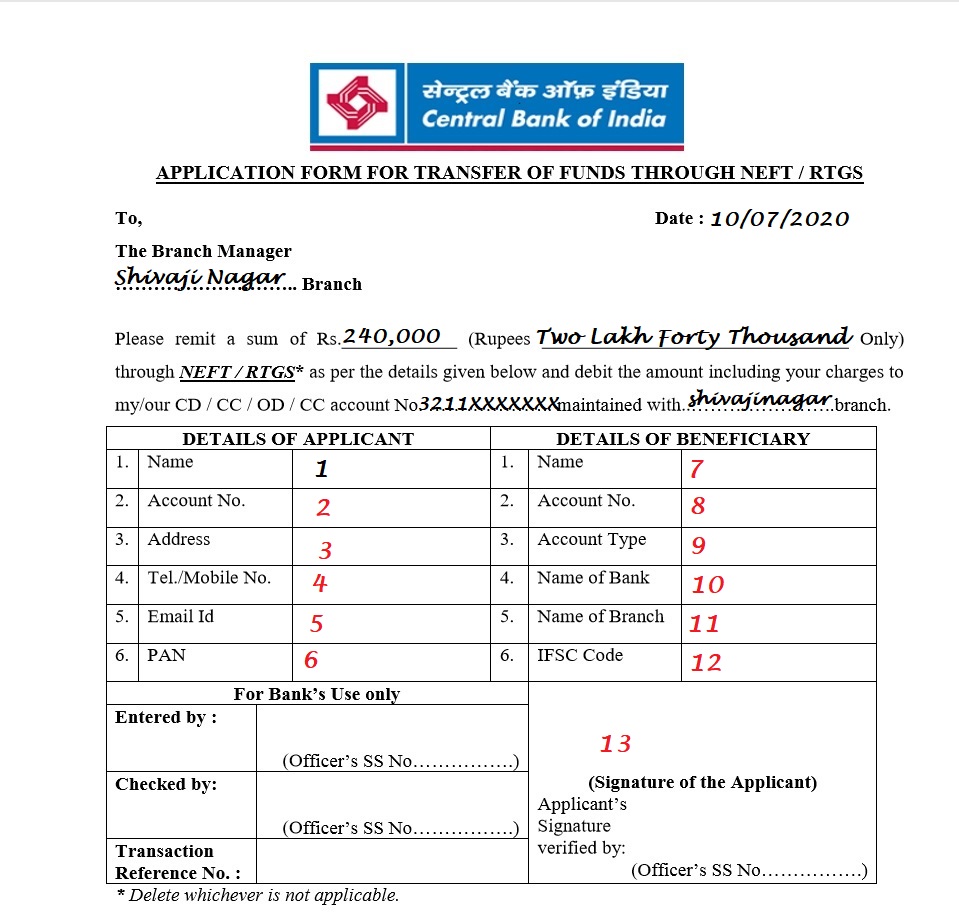

CBI RTGS Form / NEFT Form

Along with CBI RTGS Form, you will have to attach debit slip for RTGS/NEFT as well. Cash remittance up to Rs.50,000/- is allowed under NEFT only.

Download CBI RTGS Form/ NEFT Form here

How to fill up the CBI RTGS Form/NEFT Form?

The RTGS and NEFT form for Central bank of India is same. While filling up the fund transfer application form, you will have to fill up the details of applicant and beneficiary in correct way. Refer the image above to fill up the correct details on CBI RTGS form.

Applicants details are numbered from 1 to 6

No.1: Enter your Name

No.2: Your Account Number

No.3: Your address

No.4: Your mobile number

No.5: Email-ID

No.6: Your PAN Number

Beneficiary details are numbered from 7 to 12

No.7: Enter the name of person to whom funds are to be transferred

No.8: Enter account number of the beneficiary

No.9: Enter type of account viz., Current or Savings

No.10: Name of receiver’s bank

No.11: Address of the receiver’s bank

No.12: IFSC Code of the beneficiary’s bank

Net Banking

Net Banking is easy and comfortable option available to customers of the bank. With net banking service, you can complete your transaction at the tip of your fingers. In order to use this service you will have to be registered user for CBI net banking services. If you don’t know how to register for net banking then you can refer this article explaining step by step process.

However, the net banking process has it’s own limitations on the amount that can be transferred.

Individual/Corporate customers using net banking mode for NEFT and RTGS will be bound to per day limits as mentioned below

For Individual

| RTGS Limit | NEFT Limit |

| 2 lakh per transaction | 5 lakh per transaction |

For Corporate Customer

| RTGS Limit & NEFT limit |

| Specified Limit on a case to case basis, subject to a maximum of Rs.100 crore per day, either in RTGS or NEFT. |

How to transfer funds using Internet banking?

Watch the video mentioned below to perform RTGS / NEFT transfer from your CBI net banking account.