Standard Chartered Bank RTGS form PDF donwload| SCB NEFT Form Filling

Banking has evolved worldwide. Banks across the world have developed faster transaction methods. In India, Standard Chartered Bank provides RTGS and NEFT servies using form filling option. Customers of SCB can also perform these transactions using netbanking services of SCB.

Table of Contents SCB RTGS Form & Timings How to download SCB RTGS/NEFT Forms How to Fill up SCB RTGS/NEFT Form How to Write SCB Cheque for RTGS & NEFT

SCB RTGS Form & Timings

The amount will be sent in real time which means, that the amount that you are sending using RTGS mode will be settled as it is processed in the system. You need to fill up a cheque and a RTGS form provided by SCB in order to perform RTGS transaction from your account.

RBI recently released circular regarding the timings of RTGS which is now increased to 7 am to 6 pm. Hence the new timings will be as follows.

New RTGS timing window

Open for Business: 7 am

Customer transactions (Initial Cut-off): 6 pm

Inter-bank transactions (Final Cut-off): 7.45 pm

Intra-day liquidity (IDL) Reversal: 7.45 pm to 8.00 pm

End of Day: 8.00 pm

Standard Chartered Bank RTGS Form, NEFT Form Download

You can download RTGS/NEFT Form from SCB bank’s official website. Form used for both types of transactions is same. You can also download this form directly using given link

SCB RTGS/NEFT Form Filling

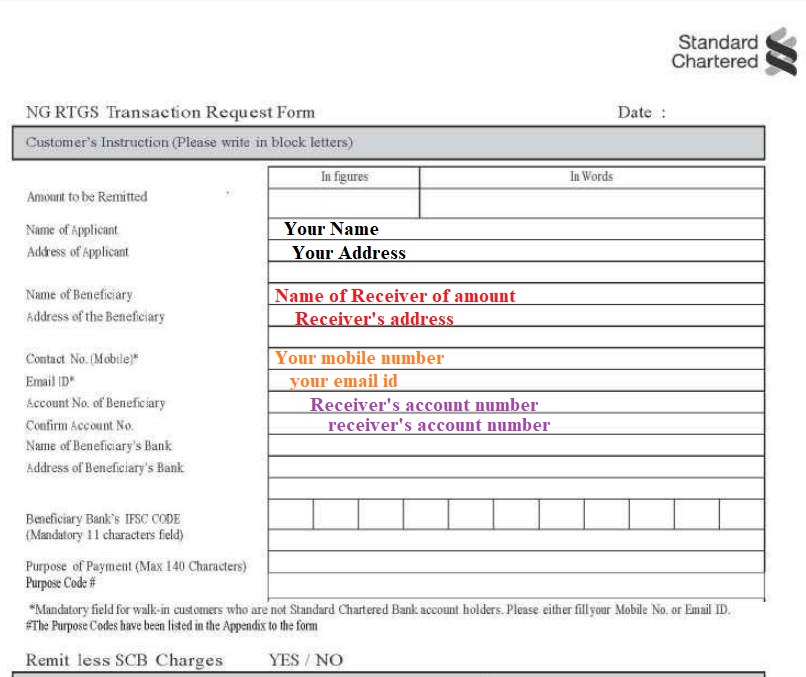

The important thing to note while filling up RTGS or NEFT form of any bank is that you should always carefully write down beneficiary details correctly. Refer the image below to understand important fields.

The beneficiary is a person who is intended to receive amount in their bank account. It is mandatory that you write beneficiary account number twice in RTGS/NEFT form in the provided space to minimize possibility of error or sending amount to wrong account.

How to write Standard Chartered Bank RTGS/NEFT cheque?

RBI has stipulated minimum limit for RTGS will be INR 2 lakhs and above. For NEFT, there is no minimum or maximum limit. Hence when you are about to transfer amount less than 2 lakh rupees, write down

“Yourself for NEFT“

For amount of rupees 2 lakhs and above write down

“Yourself for RTGS“

More about SCB

Standard Chartered Bank is a foreign bank in India. It is part of multinational banking and financial services of Standard Chartered PLC. Interestingly the company does not run retail banking business in United Kingdom. The bank has wide netword across 70 countries including India. With their services which range from consumer banking to treasury mangement, SCB is also known as universal bank.