How to Apply for Canara Bank Credit Card

Canara Bank provides various credit card services to their customers as per their usage requirements. Canara Credit Cards are issued with variants which are enabled for domestic as well as global usage. Domestic usage Cards are accepted all over India and its transaction currency is INR.

Global Credit Cards have EMV compliant chip card embedded in the card and is valid for use in India and abroad. The Chip contains vital data in encrypted format to facilitate authorisation. The Card affords protection against skimming.

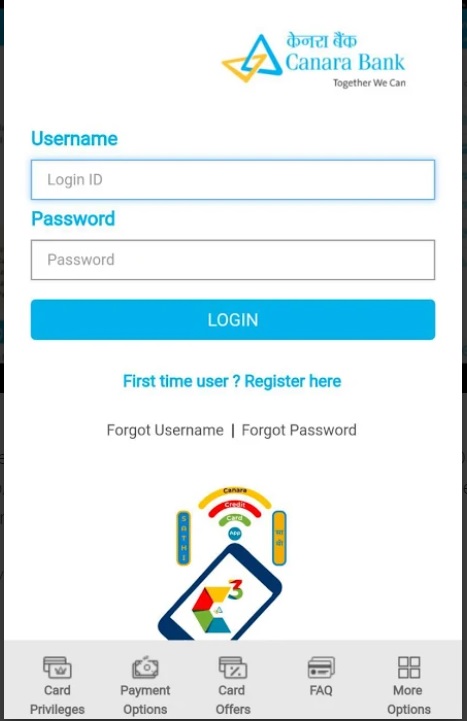

Read Also: Canara Bank Net Banking Guide

While Canara Credit Card with domestic usage is the default card, where the cardholder does not request for issue of Global Card expressly, the Canara Credit Card Global is issued at the specific request of the Card holder.

Table of Content Different types of Canara Bank Credit cards What is available credit limit? Benefits of Canara Credit card How to apply for Canara Credit Card? Canara Credit Card FAQ

Different variants of Canara Bank Credit Card

- Classic/Standard Credit Card

- Gold Credit Card

- Canara World Credit Card

- Corporate Card

1. Classic/Standard Credit Card

The Canara bank Classic card/Standard card is basic version of all credit cards available. Canara Bank provides standard card to customers with minimum gross income of 1 lakh rupees. You can enroll for free for classic/standard credit card with zero annual fees. However you will be charged for non-usage of credit card.

2. Gold Credit Card

Customers with higher annual gross income of more than 2 lakh can opt for Canara Gold credit card. This types of card can also be enrolled for free with zero annual fees. The inactivity charge for Gold credit cards is higher than classic/standard credit cards.

3. Canara World Credit card

If your annual gross income is minimum INR 10 lac then you can opt for Canara World credit card. This variant charges some amount as enrolment fees due to the premium benefits. Inactivity charges are also higher for World credit card as compared to gold credit card.

4. Canara Corporate Credit Card

Available for corporate customers of Canara bank, this credit card offers benefits for customers by providing credits for the business purpose. You will be charged with nominal enrolment fees and annual fees on corporate credit cards.

What are credit limits available for Canara Bank Credit card?

The credit limits are defined as per customer’s needs and financial transaction history.

Below are the standard limits defined for Canara Credit card:

| Type of Credit Card | Available Credit Limit |

| Classic/Standard | Rs. 10000 to 3 lac |

| Gold Credit Card | Rs. 50000 to 25 Lac |

| Canara World Credit card | Rs 1 Lac to 25 lac |

| Corporate cards | Rs 50000 to Rs 100 Lac |

Benefits of Canara Bank Credit Card

Every bank offers added benefits along with the credit card service to their customer. Canara Bank provides multiple addon benefits to their credit card customers allowing them to use available credit limit easily.

1. Free Credit Period

The free credit period is the duration of time for which you can enjoy interest free credit. With credit cards, you will be charged interest on the amount that you used from your credit card after this free credit period ends. Canara bank offers free credit period for 20 to 50 days to their customers.

2. Cash withdrawal

You can also withdraw cash through credit card. You will be charged at some fixed interest rate for withdrawal of cash using your credit card. You can use maximum 50% of your existing credit limit for cash withdrawal. However

3. Insurance

Along with Canara Credit card, you will be entitled for complementary accidental death insurance. Due to air accident as well as other than air accident insurance cover is up to Rs 8 lakh. You can also avail benefits of health insurance premiums available at concessions.

You can request for increase in standard credit limits to your branch. If you have good credit history then bank may also consider to increase the available standard limit for you.

How to apply for Canara Bank Credit Card

Canara Bank defines income eligibility criteria for different variants of credit cards as follows:

Existing customer with gross income of minimum 1 Lakh for Classic, 2 Lakh for Gold Credit card & 10 Lakh for Canara World Credit cards can apply for credit card.

Most of the times, bank prefers to allot credit cards to the customers who have existing salary account with the bank. If you are an existing customer then you can apply for credit card by visiting branch and demanding for application form for Credit card.

You can also download Canara Bank credit card application form directly using below links

Download Canara Bank Credit card application form in English

Download Canara bank credit card application form in Hindi

After downloading the form, you have to fill it completely without leaving any of the details. Signature and place application form should be filled appropriately.

Attach self signed Aadhar card, PAN card Xerox along with the application.

In case the address on Aadhar card does not match with your present address, then you will have to submit the proof of present address. This could include your driving license, Voter ID, Passport or any other valid document that verifies your current place of residence.

You also need to attach Form 16, Salary certificate, balance sheet or ITR as a proof of your income along with the credit card application form.

After attaching proper documents along with credit card application form you will have to submit the same to your base Canara Bank branch.

Canara Credit Card FAQ

Canara Credit Cards can be used for emergency cash withdrawal at ATMs, purchases at Merchant establishments, purchases on the Internet, purchases through Interactive Voice Response System (IVRS), for purchases through Mail Order / Telephone Order transactions.

Interest free credit period ranges from minimum of 20 days to a maximum of 50 days. However, fees / Service charges, as applicable, is payable for cash withdrawal / for usage at petrol bunks, Railway ticket booking, etc.

You will not be permitted to use your Canara Credit Card until the card dues are paid in full. If the default is persistent, your name may be referred to Credit Rating Agency for inclusion in the negative list, which prevents any credit assistance from any financial institution. Legal Action would be initiated to recover the legitimate dues to the Bank.

A service of charge of 2% + service tax on the balance outstanding plus applicable service tax is charged to the cardholder where card dues are not paid by the payment due date.