CUB Net banking Registration, Login, Password Reset Guide

CUB net banking guide: City union Bank is the private sector bank in India. Erstwhile the bank was known as the Kumbakonam Bank limited. The City union Bank incorporated as a limited company and established on 31st October 1904. Initially the bank preferred to play a regional bank roll in Thanjavur district of Tamil Nadu. Today the bank has more than 700 branches and ATMs reach to 1762 locations. The market capitalisation of the bank is $1.8 billion. The bank is headquartered at Kumbakonam Tamil Nadu India.

The City union Bank is very progressive bank. The bank computerized all their branches in the year 1990 and also it become the first bank introducing first on-site banking robot in 2016 named Lakshmi. Lakshmi is a humanoidrobot and capable of answering 120 questions and performs sensitive financial task and provides information related to the banking operations.

The City union bank offers various banking products for the MSME,corporate, retail as well as NRI customer through various channels. City union Bank provides digital banking facility under which bank provides internet banking, mobile banking, social media banking transfer funds through Facebook, Corporate banking, self-service banking, virtual credit card facility and lot more. Out of these internet banking facilities is the most efficient one and allows you to do your all banking activities and transaction without actually visiting the branch and at your convenience of time.

The City union Bank provides internet banking facility for retail as well as corporate customer.

Table of Contents:

1. How to Register for CUB Net Banking?

2. How to Login to City Union Bank Net Banking Account?

3. How to Reset Internet Banking Password?

4. What are features of CUB Online Banking?

5. City Union Bank Internet Banking FAQ

6. Important Links

How to register for CUB net banking?

City union Bank offers various services through internet bank facility. According to their safety and security policy, CUB does not allow self-user registration for net banking. You have to register yourself for internet banking by visiting the branch. let us see the procedure to get user id and password for internet banking.

The steps to get login credentials for internet banking

Step 1:

First of all, you have to visit your home branch where you have opened your savings bank account or current bank account. You have to submit duly field application request for internet banking with your documents and valid information. You can request the application form at the branch. You can download the form from below link.

Download CUB net banking registration form

Step 2:

Fill the form with your valid details and submit the required documents along with the form. You can submit the request for your own bank account only and with your valid signature.

In order to avail net banking facility you have tick on the option: “I wish to avail City Union Bank Internet Banking facility with Fund Transfer” under ‘For Internet Banking‘ section.

Step 3:

Your request form along with your KYC details and documents will be e processed by centralised processing cell of the bank. After verification and validation of the form you will receive user ID password and transaction password to your registered mailing address by registered post within 7 to 10 working days.

With these credentials you can login into your internet banking account.

How to Login to CUB Net Banking Account?

Once you got your credentials by post you can login into your internet banking account. The first-time login process will be as follows

Step 1:

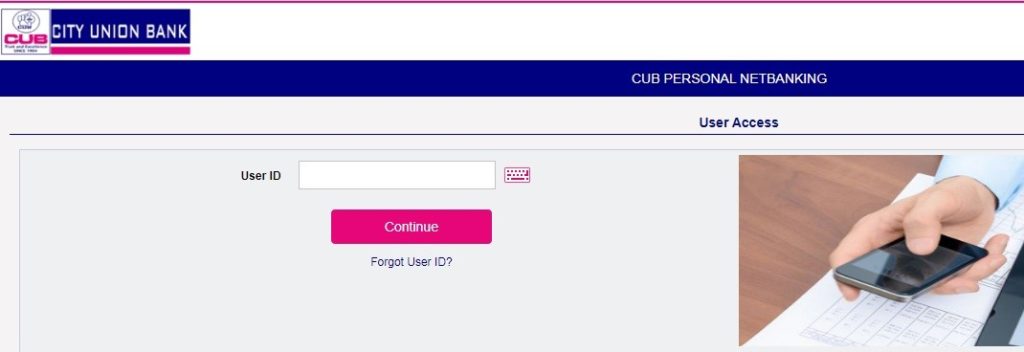

Visit the official net banking page of City union Bank or simply click here.

Next click on ‘personal banking’.

Step 2

Now enter the login ID you received with the credential kit click on continue.

After that enter your password and click on sign in

Step 3

Once you login for the first time for internet banking you will be asked to change your password and it is not mandatory you can change it on the next login. It is recommended to change it after first login and the changes will be applicable from the next login. Type the login password and type new login password in the given box

Retype the password for the confirmation. Similarly enter the transaction password you received in the kit and new transaction password which will be e of your choice that you can easily remember it. Retype the same password and click on submit

Step 4

Once you change your login password and transaction password you will be redirected to the login page once again. Enter the new login password you created and user ID to login into your account. After that new window will pop up and some security questions will be displayed. Set the security questions and answers for the questions. This question and answers will help you to retrieve your login credentials if you lost access to your account.

Step 5

After setting the security questions bank called it as challenging question youhave to select a profile image for your account. Choose the profile image and type the welcome message in the given box so that when every time you login you will be displayed with your profile image and welcome message will improve the security of your account. After doing completing these steps your account it will be set for online transaction. In this way you can activate your internet banking account with very easy steps.

How to Recover CUB net banking password?

It happens sometime when we forget the login password. Retrieving it or changing it is very simple process. City union Bank provides an easy step to retrieve your password back let’s see the step by step process of resetting forgotten password.

Step 1

Visit the officialnet banking portal of City union bank. Enter your user id and click on continue after that click on the forgot password option.

Step 2

Once you click on the forgot password link you will be on the next page for the further process. On this page the bank needs to verify your account details. Enter your account details like account number registered mobile number email ID. After that an OTP will be sent on your registered mobile number for verification

Step 3

Verify the OTP you received on your registered mobile number by entering it in the box and click on continue.

After verification of OTP will be displayed with the new set of instruction for setting up a new password.

Step 4

Follow the instructions and set a new password for your account.

How to Deactive Internet Banking Facility?

The City union Bank provides the facility to unregister or deactivate your internet banking facility. To deactivate your internet banking contact customer care service helpline at 0 44 – 712 25000. you can mail them with your request at customercare@Cityunionbank.in.

Another way of doing this is to visit the home branch with your request for deactivation of internet banking. Your request will be processed in and account will be deactivated within a week.

Features and benefits of CUB internet banking.

The City union Bank internet banking facility is very be helpful for online transactions it is the most secure way of online transaction you can perform your banking activities while sitting at home or office using internet banking. As internet banking is available 24/7 you can make your transactions at your convenience. Some facilities provided that internet banking service are as follows.

- You can wave your account balance and print your bank statement using internet banking.

- Internet banking allows you to change your registered email address and registered mobile number.

- Normally to change the ATM pin the customer need to visit but the City union Bank provides the facility to change your ATM pin online through internet banking. This is the very important feature allowed by CUB.

- The internet banking allows you to transfer funds online through NEFT and RTGS to any other bank ok or same bank

- You can pay your utility bills like credit card bills phone bill

- You can order a new cheque book

- You can pay the Insurancepremium and purchase general insurance through net banking

- You can do online shopping through internet banking and lot more things can be done using internet banking facility.

- City union Bank allows you to enable multifunction factor authentication and change authentication image or your account

- It also allows you to pay direct taxes and commercial taxes using internet banking. You can also request that view tax credit statement.

- You can apply for mobile banking through internet banking portal. You can also change and generate MPIN for mobile banking.

City Union Bank Internet Banking FAQ

Ans: No. To activate internet banking facility on your account you have to visit your home branch and submit your request along with the form. After the verification and processing your request you will be received internet banking login credential to activate internet banking.

Ans: No. Currently the net banking facility of City union Bank is free of charge. you can do any number of transactions using internet banking.

Ans: There no specific criteria for availing the internet banking facility. Only criteria is to have savings account or current account with the city union bank.

Ans: Yes. For sure you can delete your internet banking account or unregister yourself from internet banking, to do this a written instruction from you to blockor un- register request for your internet banking should be given to your home branch and your account will be unregistered for internet banking.

City Union Bank Important links

Official website: www.cityunionbank.com

City Union Bank Internet banking

Branch and ATM locator

Downloads of Application and forms

Customer care email ID: customercare@Cityunionbank.in

Thank you sir, I was confused for signup process. CUB has very complicated process of net banking.

Why is city union bank’s net banking registration process so much confusing?

Among the banks in india , City Union bank has worst online portal , it is very unfriendly .