ICICI Bank RTGS Form, ICICI NEFT Form Download [.pdf]

ICICI Bank is leading private sector bank in India. Along with digital banking services such as net banking, the bank also provides quick transfer of funds through RTGS system. In order to send fund through RTGS, you need to fill up and submit a form at your ICICI bank branch.

What is RTGS & NEFT in ICICI Bank?

RTGS stands for Real Time Gross Settlement i.e., real-time settlement of funds individually on an order by order basis. ‘Gross Settlement’ means the settlement of funds transfer instructions occurs individually. Large value transactions which are more than 2 lakh come under RTGS fund transfer system.

NEFT also offers fund transfer service but the settlement is not in real time. Instead, the fund is transferred with batches.

ICIC bank offers both RTGS as well as NEFT services using

1. online mode i.e., through ICICI net banking &

2. Through offline mode which is by visiting the branch.

If you have not registered for ICICI net banking then you can read this guide which will help you to get registered for net banking. If you don’t want to register for net banking then you can opt for second option which is by visiting branch.

Download ICICI RTGS Form, NEFT Form

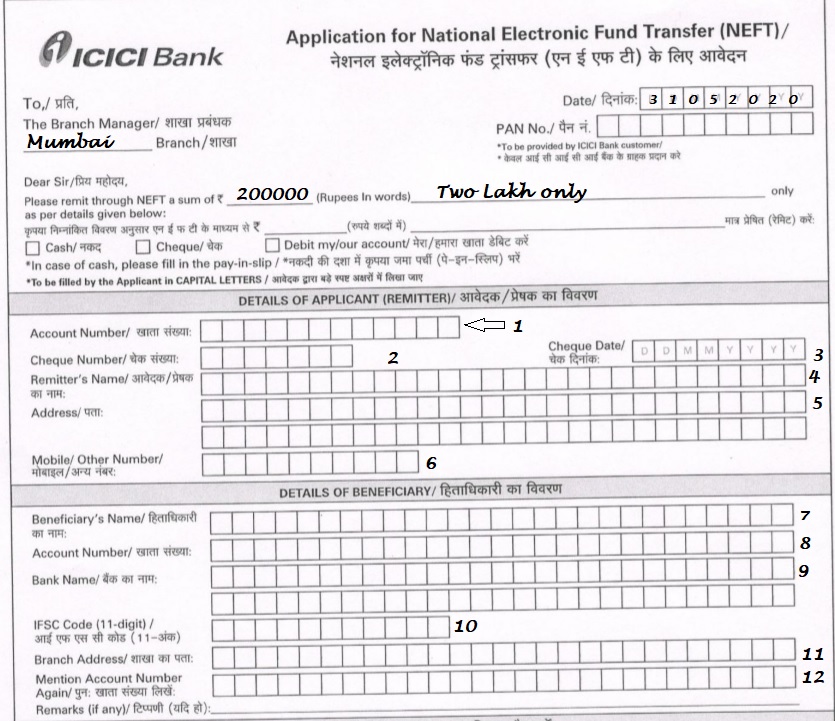

In order to perform RTGS/NEFT transaction by visiting branch, you will need to get ICICI Bank RTGS form, or ICICI NEFT form first. The form will look like this.

Click here to Download ICICI RTGS, NEFT Form pdf

How to Fill up the RTGS form?

You refer and fill ICICI RTGS or NEFT form as below

As in above image, details of applicant are to be filled from 1 to 6 and details of beneficiary are to be filled from 7 to 12.

Details of Applicant (Refer the serial number with above image).

1. Enter your account number at ICICI bank

2. The ‘6 digits’ cheque number attached with the RTGS form

3. Date of cheque

4. Your own name

5. Your residential Address

6. Mobile number

Details of Beneficiary (refer SNo. 7 to 12)

7. Name of the person to whom you are sending money

8. Account number of the receiver of funds

9. Name of the bank where the receive holds bank account

10. IFSC code of bank

11. Address of the branch

12. Re enter the account number of the receiver

RTGS NEFT Form FAQs

Ans: The minimum amount to be remitted through RTGS is Rs 2 lakh. The maximum limit is Rs 10 lakh per day.

Ans: Transaction charge for Real Time Gross Settlement (RTGS) initiated through online modes i.e. using Internet Banking, iMobile app, Mera iMobile app and Pockets app is Nil.

For RTGS transactions at branch, charges are as below:

Above Rs 2 lakh upto Rs 5 lakh: Rs 20 + Applicable GST

Above Rs 5 lakh upto Rs 10 lakh: Rs 45 + Applicable GST

Ans: The beneficiary bank has to credit the beneficiary’s account within 30 minutes of receiving the funds transfer message.