IMPS – Immediate Payment Service – What is it and How to use it?

IMPS – Immediate Payment Service is frequently used term in today’s financial world. With growing digitalization of financial system, a new payment service was needed to facilitate funds transfer. Hence, NPCI – National Payments Corporation of India introduced IMPS in 2010. With IMPS – the inter bank funds transfer became much faster and easier.

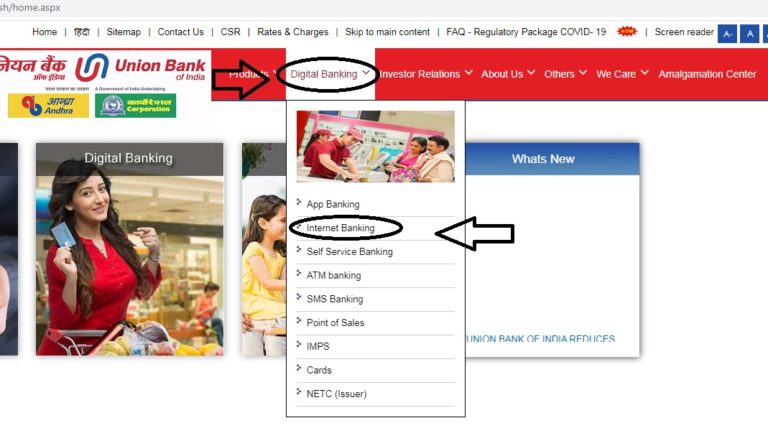

IMPS service is available for 24×7 and you can transfer funds easily using your smartphone. It is now also extended to other channels such as ATM, internet banking etc.

IMPS allows 24×7 inter-bank funds transfer. This makes banking services available for anyone regardless of bank holidays.

There is maximum limit of funds transfer transaction using IMPS which is INR 2 lakh per day. This makes urgent money transfer transactions easy.

You can read about CBI IMPS transaction here.

How do you use IMPS?

IMPS is used to transfer funds from your own bank account to beneficiary’s account. Hence you will be needing following details to use this service

Beneficiary’s account number

IFSC Code

Beneficiary’s Bank Name

Name

The above are commonly required details for all the banks and additional details may vary for different banks. After adding the beneficiary you will have to wait for 24-48 hours as bank reflects changes to your account. Once the name of beneficiary appears in the list, you just have to select that name and enter amount to be sent. Enter your transaction password and send money.

In order to send money using mobile phone, you will need MMID (Mobile money Identifier) of beneficiary and your MPIN. MMID is uniquely allotted to each account of an individual, which is a 7 digit code. It is mandatory to link mobile number with bank account to use this service.

Features of IMPS

- Fast and assured way to send money from your account to intended beneficiary.

- It is safest way to transfer money as payments are secured through this channel.

- It is available for 24 hours a day and 7 days a week.

- The amount to be sent can vary from INR 1 to INR 2 lakh

- To use the IMPS using mobile phone, you will need MMID and MPIN of the beneficiary.